In early 2024, the Max Flessa Bank faced the challenge of modernizing its internal business processes. In addition to digitization, the company also needed to comply with finance-specific regulatory requirements efficiently. The key question was how to make the existing, partly paper-based processes fit for the future. The goal was to work more efficiently and respond more flexibly to the changing demands of the market and regulators.

The solution: CIB flow - the platform for process automation

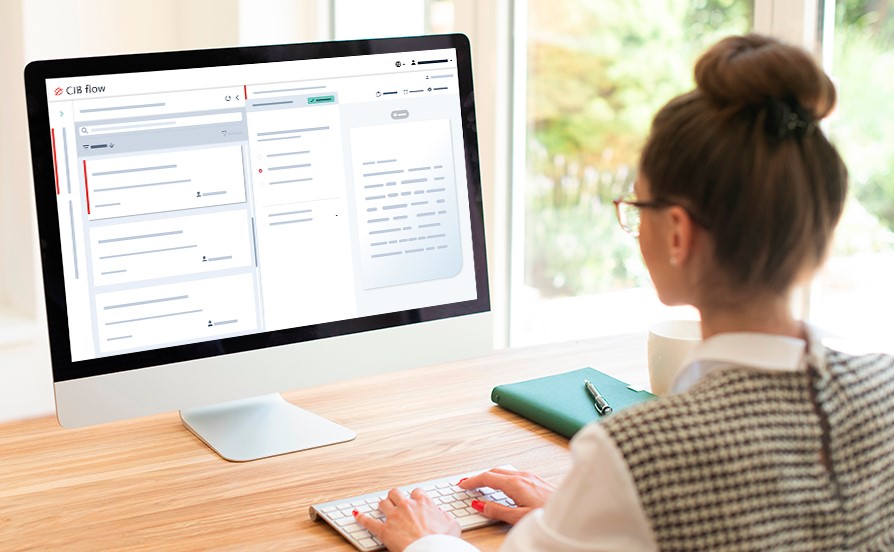

In January 2024, a feasibility study was conducted together with Flessabank to analyze and optimize a real business process from banking operations. It quickly became clear that the solution lay in the use of CIB flow. The platform enables the bank's employees not only to automate processes, but also to design and customize them themselves.

Step by step to a process-driven organization

In March 2024, the bank's technically skilled employees were trained to become process designers, enabling them to develop processes independently. This training laid the foundation for long-term success. After a short training period, the process designers were able to create their processes and forms and make them available to the organization.

A particular advantage was the seamless integration of existing document templates from the core banking system agree21 into CIB flow. These could be easily transferred and reused, saving the bank considerable time and costs. The combination of existing structures and new, digital processes enabled the bank to modernize its processes efficiently.

In July, the newly trained process designers worked with us to develop the first processes. In August, five enterprise-wide processes successfully went live. The bank will digitize and automate many more processes by the end of the year.

Efficiency, transparency and sustainability

With the implementation of CIB flow Flessabank has not only accelerated its digitization, but also significantly reduced its throughput times. The new processes are more transparent, enabling the bank to manage its internal processes more efficiently and identify bottlenecks early on.

Thanks to the parallelization and automation of the workflow, the bank also works more resource-efficiently - a clear competitive advantage in an industry where time and precision are crucial.

Today, Flessabank can develop its processes independently and adapt dynamically to future challenges.

Would you like to find out more? Click here for more case studies for your industry.